THE shifting trade dynamics caused by the two-tier tariff regime introduced by the United States carry significant implications for Asia-Pacific and therefore governments across the region must be prepared to deliver tailored support to firms and workers as Global Value Chains (GVCs)evolve, an expert appraisal by the Economic and Social Commission for Asia and the Pacific (ESCAP) recommends.

The expert appraisal put together by three ESCAP officials focussed on the impacts of the two-tier tariff regime introduced by the US on April 2, comprising a 10 per-cent universal baseline tariff and elevated country-specific tariffs of up to 50 per-cent targeting 57 countries, including many in the Asia Pacific region, with limited exemptions.

Released on Tuesday 22 April, the expert appraisal says although the US suspended country-specific tariffs on 9 April for all countries, except China, policy uncertainty remains and subsequent signals have been mixed because though product exemptions were expanded to include certain electronics, the US also launched new Section 232 investigations into imports of semi-conductors and pharmaceuticals. According to the US government, the investigation is conducted under its Trade Expansion Act of 1962 to determine the effect of imports on the US national security.

The ESCAP expert appraisal says these development suggest the potential for further unilateral trade actions and highlight the persistent uncertainty in the global trade environment.

“These shifting trade dynamics carry important implications for the Asia-Pacific region, where deep integration into global value chains, characterized by high reliance on imported inputs, intensifies both direct and indirect exposure to evolving US tariff measures.

“Direct exposure occurs when a country’s exports to the U.S are directly subject to tariffs. The actional burden can be heavier than the announced tariff rate. This is because tariffs are applied to the full shipment value, even when much of it comes from imported inputs. As a result, the cost falls disproportionately on the exporter’s own smaller share of value-added.

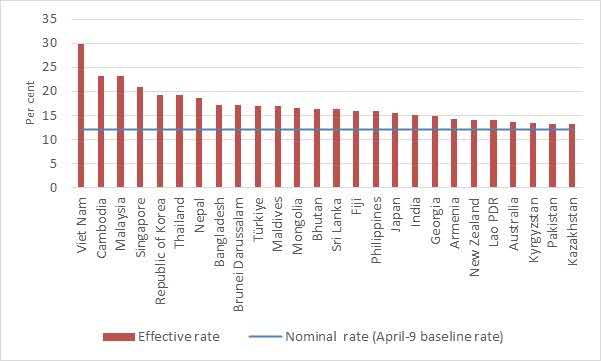

“For example, only $51.5 of Cambodia’s $100 textile shipment to the U.S is domestically produced. A 10 per cent tariff on the full value translates into an effective 23 per cent tax on Cambodia’s actual contribution. In fact, analysis using ESCAP’s Regional Integration and Value Chain Analyzer (RIVA) shows that whilst most Asia-Pacific economies are subject to the same 10 per cent baseline tariff, many face an effective tariff burden exceeding 15 per cent (figure 1),” the expert appraisal says.

The ESCAP expert appraisal says indirect or pass-through exposure arises when a country exports intermediate goods or services that are later embedded in another country’s exports to a tariff-imposing market.

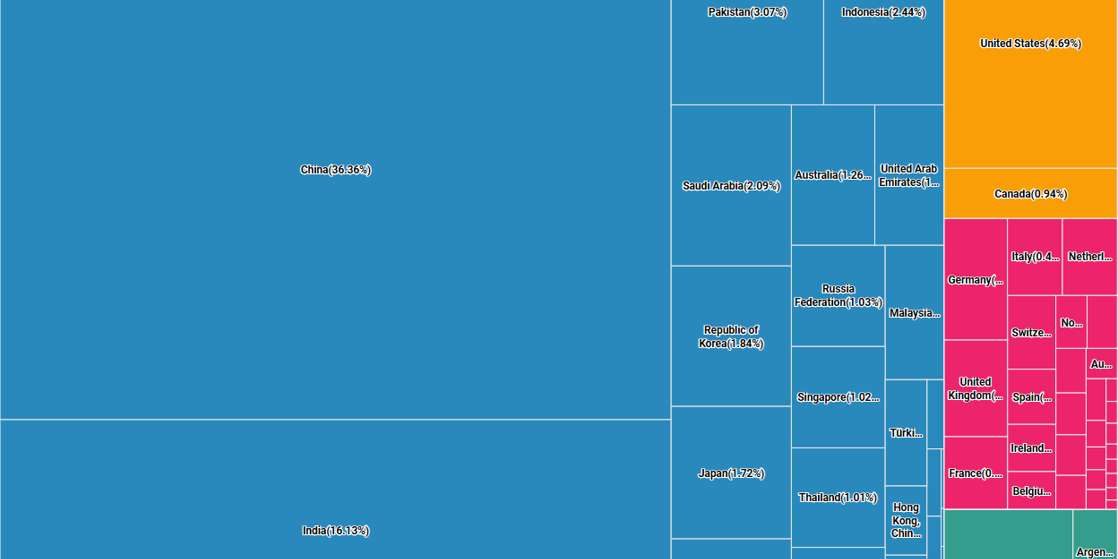

“For example, in 2022, Bangladesh exported approximately USD8.2 billion in textiles and textile products to the U.S, with one-third of that value derived from upstream trade partners. Notably, the U.S firms themselves, along with firms in China, India, Pakistan and Indonesia, are key contributors to Bangladesh’s textile exports, making them directly exposed to the U.S tariffs on those exports (figure 2),” the ESCAP expert appraisal adds.

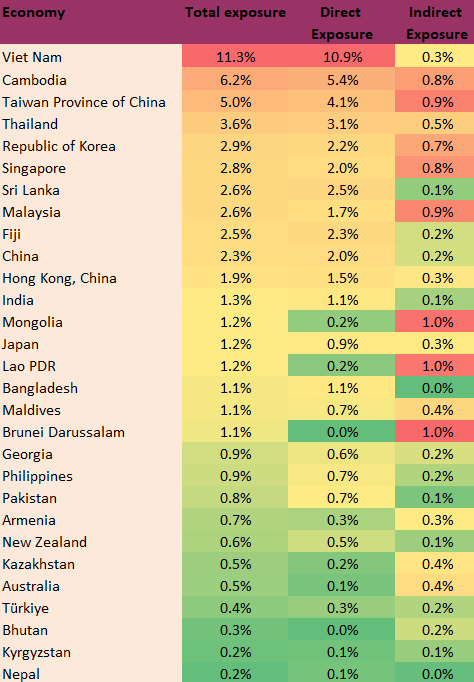

The ESCAP expert appraisal says the impact of the US tariffs is expected to vary widely across the Asia-Pacific region, adding that economies with high direct export exposure such as Vietnam, Cambodia and Thailand could face significant trade-related contractions with direct exposure through GVCs may also dampen growth in upstream economies supplying raw materials, parts and components.

“For example {as shown on table 1}, Brunei Darussalam, Mongolia, Lao People’s Democratic Republic, Malaysia and Singapore could see direct exposure equivalent to approximately 1 per-cent of GDP. In contrast, economies with larger domestic markets or more diversified export structures, particularly those with strong services sectors, are better positioned to absorb the trade shock,” it adds.

The ESCAP expert appraisal says for both policymakers and industry leaders, identifying the source of vulnerabilities is essential for crafting targeted and forward-looking responses, adding that these strategies should not only aim to mitigate current risks, but also strengthen long-term economic adaptability.

It adds that evidence-based analysis is essential to guide targeted support, and cites a sectoral data on how Thailand is indirectly impacted through its upstream supply chain linkages with Vietnam as an example. The data highlights the Thai manufacturing sectors identified to be the most vulnerable, and these are its leather and textiles, food and beverages, other light manufacturing and electrical equipment sectors.

The expert appraisal says this insight suggests that coordination between Thailand and Vietnam, focussing on these sectors could mitigate shared risks and enhance resilience.

It adds that beyond bilateral efforts, regional coordination with supply chain partners is essential to address short-to-medium-term challenges and this is particularly important for the following reasons:

- Relocating supply chains requires long-term planning guided by infrastructure, labour, innovation-capacity and regulatory stability rather than just short-term tariff shifts;

- Strategic uncertainty remains high and no country is fully shielded from tariff exposure. In the current unpredictable global trade environment, firms will remain cautious about investing or reconfiguring supply chains.

In light of these shifting trade dynamics, the ESCAP expert appraisal says governments across the Asia-Pacific region must be prepared to deliver tailored support to firms and workers as GVCs continue to evolve, and emphasises that informed domestic and international policies require sector-specific assessments.

And in this context, the ESCAP appraisal says the ESCAP TINA tariff simulator offers a valuable tool for preliminary assessment of Asia-Pacific tariff exposure at the HS 6-digit level.

By DELI-SHARON OSO

In Beijing, China